Skeptical Insight #14

May 18, 2025Apr 27, 2025

Did Tarrifs mark a local bottom in the S&P?

In This Week's Issue:

- Equitiy Markets

- Maximum Pain

- Did the Tariff News Mark the Bottom ?

- Crypto Market Update

- Bounce Confirmed?

Equities

Maximum Pain

Last week we discussed the impact of tariffs and how I didn’t expect them to stick for long. Trump is already backtracking and China is now retaliating by stopping raw metals being shipped to the USA. A big shock to Trump's plan.

Unfortunately for Trump, China is a big enough empire to throw their weight around and fight back against him. I guess he's still learning that..

At this point, I would say the worst (news wise) is behind us and it can only get better from here as Trump begins to negotiate with his fellow leaders. In the meantime, new alliances will be formed without the US involved.

China has somewhat rekindled with Japan, two historically divided countries, and have now struck a trade deal. This is the kind of stuff that happens when economies begin collapsing or as Ray Dalio puts it “a changing world order”.

As one country starts to get over confident in their dominance, they will over negotiate. This causes the rising power to look for alternative trade lines with less friction. Inevitably the result of this is that it will accelerate the collapse of the US economy.

History shows that this process will occur over a number of years, but the signs are becoming increasingly evident.

As we move further down the road of a "change in world order" we will see more geopolitical tension between countries. This can happen in a number of ways and doesn’t always imply kinetic contact (war). For instance, we could see the US ban trading stocks in China, similar to the sanctions they put on Russia when they invaded Ukraine.

This would essentially put a halt on all world trade as Russia's GDP is a small fraction compared to China's.

I do hold some Chinese equities but understanding that risk allows me to allocate accordingly. In other words, if sanctions are placed on US investors, it wouldn’t kill me. Even if they were locked up for 5 years or so I would be confident holding those equities for that time.

It would be just my luck that I would naturally turn into a long-term investor, which at this point, suits me.

Practically all western capital has left China, which is why their stock market is taking a fair hit. Most Heggies aren’t comfortable holding positions that long when they have sanction risk hanging all over their heads. The last thing they want is one of their investors to ask for their money back when it's locked up in China.

As retail investors, we don’t have the same issue and often it can be a benefit to us that we don’t have to answer to investors –– as long as we understand the risks at play.

Did the Tariff News Mark the Bottom?

Since the tariff news was released all of the major indexes have bounced. This normally occurs as bad news scares retail out of positions before turning around. We saw this to an extreme during schmovid.

I often wonder how they cause maximum pain to retail. Either it is a fast recovery bouncing 20% quickly or a slow grind back to the upside followed by continual negative news narratives. Except this time they'll hit you from another angle like, "Market is Crashing!" or "Recession Confrimed".

This does two things. First, those who sold at the bottom either have to get back in quickly. Or second, they are waiting for ‘one more crash’ before they get back in. Either way they feel like they are taking a loss.

The emotional games this market will play with the untrained are evident the more time you spend watching and observing the markets.

Crypto Market Update

Bounce Confirmed?

In the last two weeks we have experienced a lot of positive price action. I pointed out in Newsletter #13 that I would be looking for bottoming structures to begin to form before we see more positive price action. Crypto, in typical fashion, pumped out of the area with minimal accumulation.

Bitcoin benefited from this positive price action and is up over 13% over the past two weeks. You can see below that the Stochastic RSI and MACD are both curling to the upside; the RSI has also held the all-important bullish level of 40.

We’re now fighting levels of resistance on lower timeframes, as shown below, so I would expect an ABC correction to the downside before we push higher. The higher timeframes hold more value, and with the indicators all showing bullish signs, I am expecting to see Bitcoin trade to higher levels over the next month or so.

Last week I showed this chart of Sui vs. Siacoin from 2017:

It’s fair to say that it is following the structure better than I expected. I don’t think we’re totally out of hot water yet, those pull backs on Siacoin are 40% as it climbed through the retracement levels. This is typical for both small cap stocks and cryptos as we return out of bear markets.

It’s a friendly reminder to expect volatility and to position size accordingly to maintain some level of sanity (if possible). During the volatile times your conviction will be tested to extremes. No one can take responsibility for buying or selling except you. It’s you vs. the market. You'll need a thesis that is etched in stone until the underlying fundamentals change.

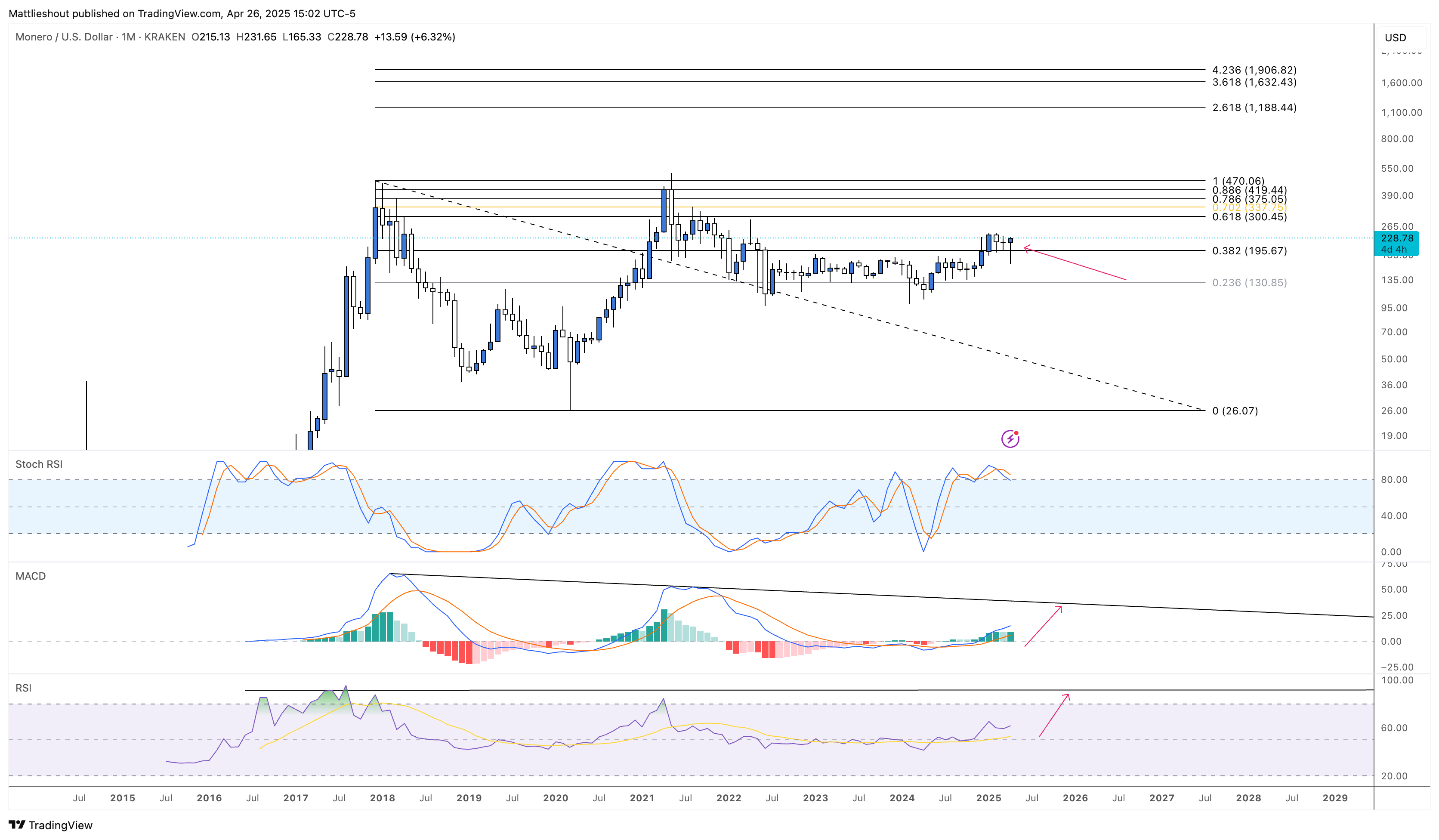

It’s been a while since we touched on Monero, my favorite privacy coin at the moment. Monero allows you a medium to send money that cannot be tracked. Like freedom of speech, we should be advocating for freedom of money. We should be able to move our money without the eyes of banks or governments watching over our shoulder.

And for those who think ‘it’s great for illegal activities’ it’s not the money that is illegal, it's the humans that move it for illegal activities who are the culprits.

Its current price action is one of the most bullish charts I have seen in a long time. If this month can close with a bullish hammer candlestick as it looks now, it would confirm as a retest of the Wyckoff accumulation range. All the indicators on the monthly timeframe are opening in a way that support this thesis.

For those unfamiliar with Wyckoff Schematics, have a look below. Monero looks like it has just completed its Sign of Strength (SOS).

Famous last words but “nothing stops this train”.

And here’s some confluence for an exiting.

Both the 2018-2025 and 2021-2025 Fibonacci extensions are at near enough the same price. Either it’s too good to be true or this is extreme confluence that a 700% price increase is on the cards.

My advice, just don’t run out of patience.

On top of the three examples above there are a number of examples that liquidity is returning to the crypto market.

As mainstream media continues to point out the problems with tariffs the flow of capital is showing me something different.

Maybe I’m too skeptical but I’ve seen this happen too many times –– bottoms form in combination with extremely bad news and tops form with the opposite.

Stay skeptical,

Matt Lieshout

DISCLAIMER: This newsletter is not investment advice. It is provided solely for educational purposes. Our aim is to enhance your understanding and decision-making as an investor; however, you are solely responsible for conducting your own due diligence and consulting a qualified financial professional prior to making any investment decisions. Skeptical Investing and Matthew Lieshout reserve all rights to the content of this publication and related materials. Proceed with caution and at your own risk.

Sparked Intrigue?

Join our mailing list to receive the Skeptical Insight Newsletter where we cover everything from geopolitics to macro investing and everything in-between.

We hate SPAM. We will never sell your information, for any reason.