Skeptical Insight #13

May 18, 2025Apr 13, 2025

In This Week's Issue:

- Equitiy Markets

- Tariff's

- Is the Bottom in?

- Crypto Market Update

- Can it Stop Dropping?

- Bitcoin Dominance

Equities

Tariff's

The amount of tariff news this week will be enough to drive anyone crazy, never mind the emotional toll of the market swings.

One moment Trump is putting Tariffs on everyone and the next, he takes a 90 day pause (except for on his good buddy Xi).

At this point, I don’t think Trump cares that the market is down. This early in his campaign, he can still blame the underperformance of the stock market on Biden, which is why he is willing to take the risk. He’d rather have markets rise over the next couple of years as we head into the midterm elections.

Tariffs themselves are inflationary by nature and in this case, especially for Americans. If the cost of goods increases over night, then the businesses selling within America must absorb that sudden increase in cost. It will take time for the cost to be absorbed by the marketplace or for businesses to find alternatives to keep costs down.

Trump’s goal is not to increase the cost of living in America, and he has a bunch of smart people around him that will know this is the result of Tariffs.

So, why’s he doing it?

Control.

He wants to make the American people feel as though they are on the top of the world again. And if I could bet, Xi also wants the same thing.

Let me riddle you this..

Trump puts Tariffs on China – Let's say they agree on 100%, despite killing American small businesses.

China being China, can now punch back in several different ways.

I'll give you one example to ponder:

China Owns 51% of all shipping manufacturers in the world and America owns 0.1%.

Now imagine that China agrees to pay the 100% Tariff to USA. Trump looks like he got a great deal.

But what if China comes back by putting an additional charge on ships crossing over to America..

I think you can see where I’m going.

The cost just gets moved to another line of business. Xi tells his citizens he has the deal of a century with USA. And both countries believe they came out on top.

It’s a win-win for both sides, as long as you aren't a skeptic and dig into it. too far.

Both will be playing the media, so a friendly lesson not to take everything at face value.

The global business world we operate in is all interwoven together and one small change in economic policy will have cascading consequences. Even if you think you have your head wrapped around the tariffs and their implications, the downstream effects can be drastic. It requires second and even third order thinking to wrap your head around. One little change can throw off the whole matrix.

So, in my opinion it is better to zoom out and look from above the chaos to determine your next moves.

Those who can look at the market from a 40,000 ft view will notice the changes that are happening admits the chaos. Capital is shifting and will continue to do so, especially now that they have the volatility of the market required to move the capital. It makes it much easier for the big boys to make trades when more capital is getting sloshed around.

Below are some charts to demonstrate my 40,000 ft view.

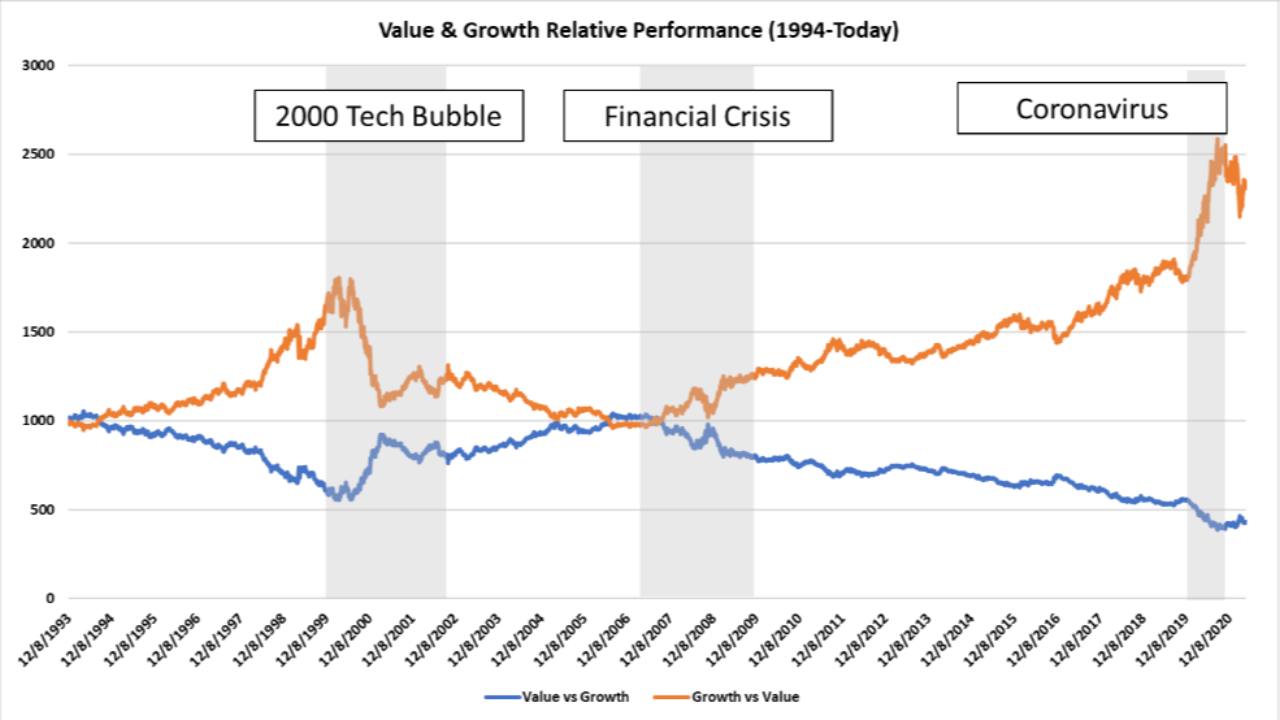

The divergence in value vs growth is still very apparent. If the Tarrif’s are in fact inflationary like they always are, who does that benefit more? Your energy producer or the MAG-7? Let me tell you. It’s value – mean reversion is around the corner.

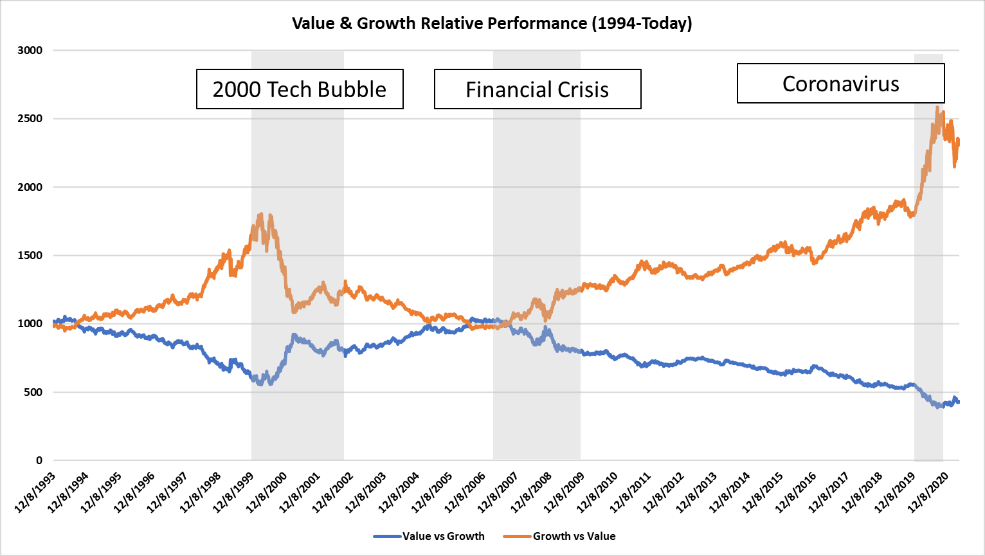

Above I’m comparing the Fidelity Global Commodity Stock Fund as a proxy for the commodity sector against the NASDAQ. Obviously, we have seen extreme over performance by the NASDAQ against commodities since 2010. It looks like we have been creating a nice bottom for the last 5 years as investors have begun to move capital into more reasonably valued stocks. They're patiently waiting for a rebalancing.

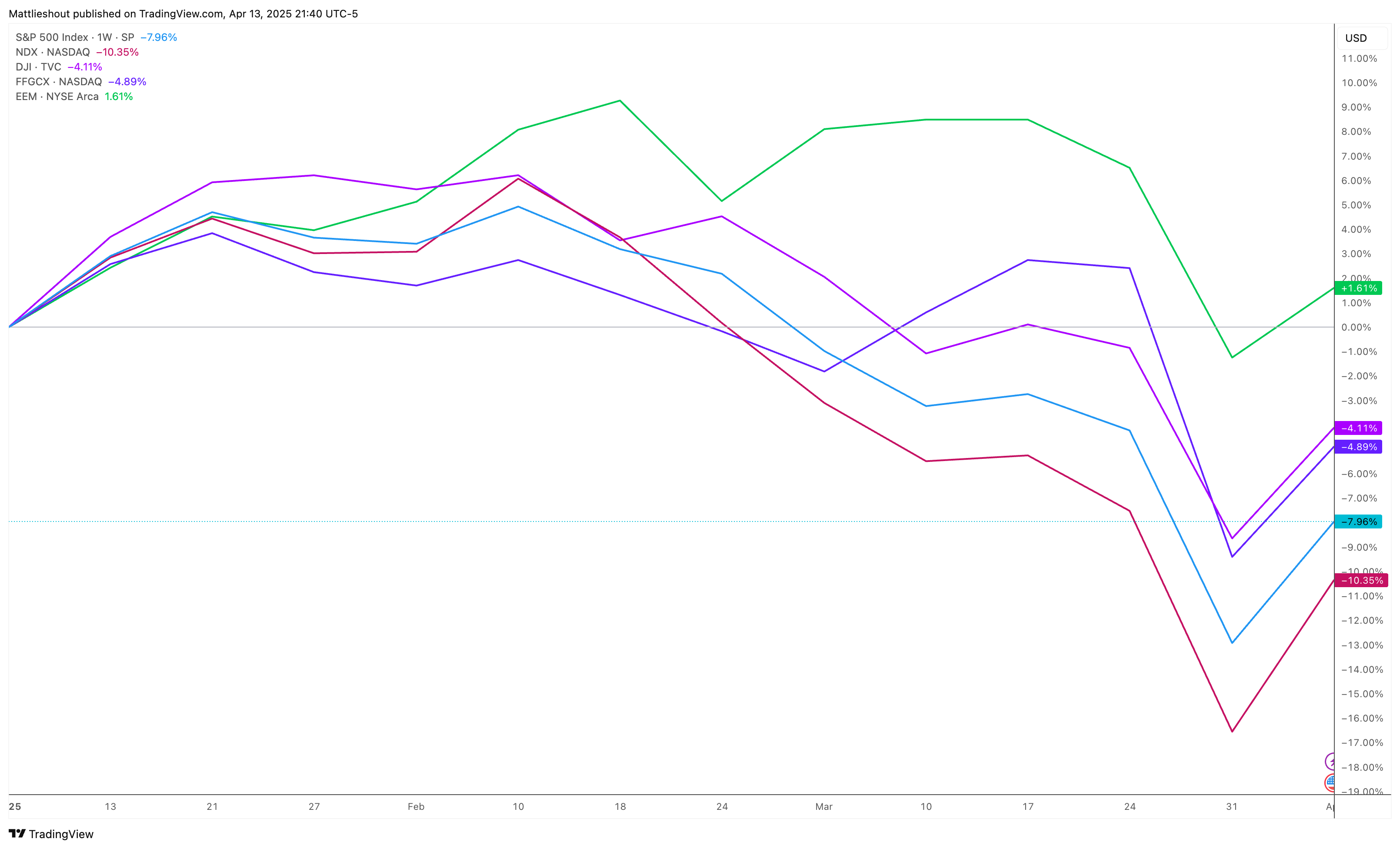

Below, you can see the performance of the NASDAQ, SPX, DJI, Emerging Markets (EEM), and Commodities (FFGCX) since the turn of the year. You’ll notice emerging markets and commodities have held up better despite the recent sell off.

Is the Bottom in?

In my last newsletter, I pointed out that despite the underlying recession characteristics of the market, I am still expecting a bounce to come as the rotation game continues. Even I didn’t expect the Russel to drop as low as it did, however, this can often happen when you have a news event, as big as tariffs, that cause uncertainty and the automatic liquidations of stops and portfolios.

I saw a video of a heggie that lost $150M of client capital during the liquidation event. I could guess that he had a leveraged portfolio that was heavily weighted towards the MAG-7. Even a 30% drop would be enough for a normal person to lose there mind, let alone using leverage to make matters worse.

And you thought you had a bad week?

Down 32% from the recent high..

Also, notice when they made this ETF - November 2024. These slimy funds only create ETF’s when there‘s enough retail euphoria to sell a product that they earn a % of ’assets’ under management. Typical signal to run for the hills.

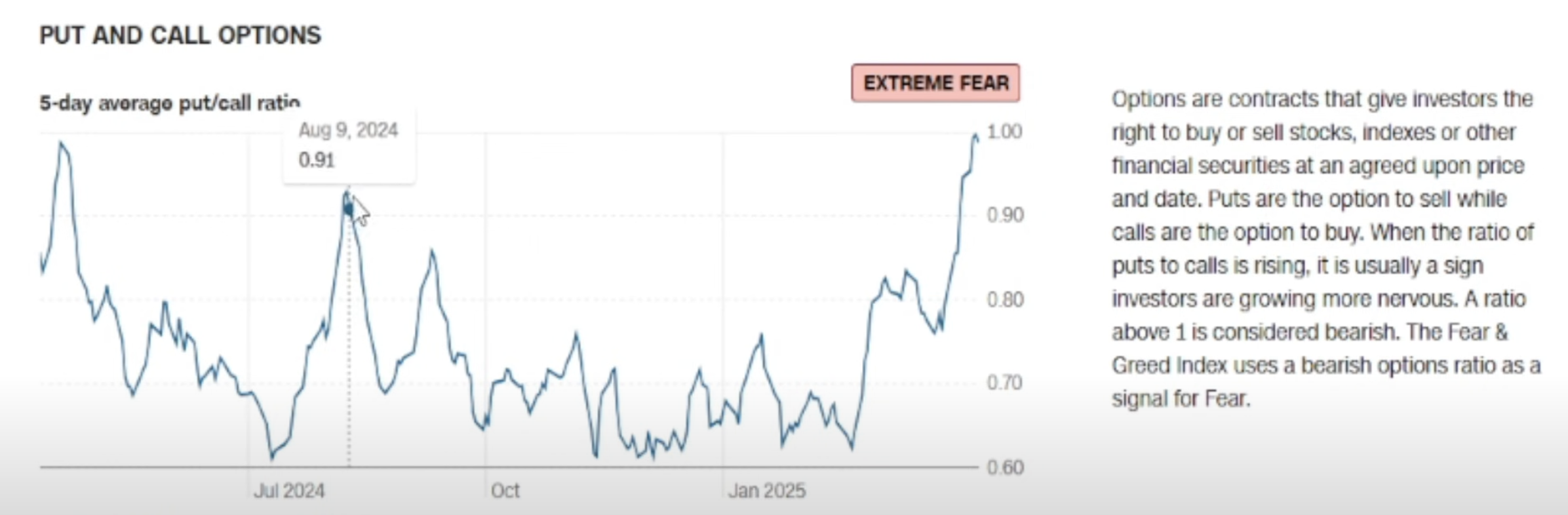

As we look for a bounce to come in the market we can look to the put/call ratio in the market right now. It is sitting at 99% which means that everyone is shorting the market right now.

As a skeptic, I ask myself the question, ‘how could they cause maximum pain?’

It only feels right when confidence to the downside is so extreme that they would blow all those puts out of the water. Even the financial media has reached extreme capitulation. Literally all mainstream media outlets are calling for a recession.

After years in the market, I can see right through their lies. They’re playing on human's emotional heart strings.

We’ll have a bounce.

Trump will say he got America’s economy firing.

And he probably won’t – it’ll just be a little less bad, because they started printing money..

Through it all, remain calm and buy cheap assets that you can hold for 5-10 years and you’ll end up doing quite well.

Crypto Market Update

Can it just Stop Dropping?

Despite large drawdowns in the equity markets, crypto has (actually) held up relatively well considering its volatility.

That could also be because its been getting hammered since December 2024.

Although the liquidations cause the Total Crypto Market Cap to double bottom, I still see positive signs on the higher timeframe.

Let me show you some examples:

If we look at the Bitcoin structure from 2021 and shrink it down to the current price action on Bitcoin, we see a number of similarities. The FTX collapse in November of 2022 marked the low, MSM was telling you crypto was dead. Doesn’t the tariff news make you feel something similar?

SIA in 2017 vs SUI of current time is another example of possibile liquidity returning to crypto assets.

Here's another example of ETH in 2016 vs the current XRP price action. Looks like we could have reached max pain in the markets. Definitely keeping my eye on this one.

Even if the bottoming process takes a while to work it-self out, I do believe we will continue to the upside.

Markets are telling a story, you just need to turn that story into a set of hard instructions that pertain to future outcomes within the market. You need to become robotic by using a series of if-then statements to enter and exit investments.

Bitcoin Dominance

Bitcoin Dominance, a metric to compare how much $$ is tied up in Bitcoin vs. the rest of the crypto market, is leaving levels where we could see a change of structure.

And I wonder if the ‘stablecoin dominance’ (BTC, ETH, USDC, USDT) has begun dropping from resistance.

Cheeky bugger’s been hanging around the 0.702 Fibonacci retracement for more than enough time. Especially after breaking structure to the downside – highlighted by the pink arrows.

For this reason, I am predominately positioned in altcoins and I am using the bitcoin dominance as extra confluence on my positions.

You will notice that each ‘bullrun’ in altcoins has occurred when the dominance is dropping rapidly. That signals that people are more apt to sell bitcoin and rotate it into the smaller market cap coins which are further out on the risk curve.

If you notice, it’s a similar approach to the stock market. A rotational top. I’m just hiding out in places that could benefit from the rotation. Only time will tell if I'm right or not.

Until then, stay skeptical,

Matt Lieshout

DISCLAIMER: This newsletter is not investment advice. It is provided solely for educational purposes. Our aim is to enhance your understanding and decision-making as an investor; however, you are solely responsible for conducting your own due diligence and consulting a qualified financial professional prior to making any investment decisions. Skeptical Investing and Matthew Lieshout reserve all rights to the content of this publication and related materials. Proceed with caution and at your own risk.

Sparked Intrigue?

Join our mailing list to receive the Skeptical Insight Newsletter where we cover everything from geopolitics to macro investing and everything in-between.

We hate SPAM. We will never sell your information, for any reason.