Skeptical Insight #12

May 18, 2025Mar 30, 2025

Is there more room to go in the Russel 2000?

In This Week's Issue:

- Equities

- Market Cycles

- Bonds Are Telling Us Something:

- Yield Curve, Interest Rates

- Crypto Market Update

- The Consolidation Continues

- Emotional Management

Equities

Market Cycles

I'm not much of a Historian however, history can sure teach us a lot, and economic history is no different. As we study the past, we can see that where we sit today is no different to other points in time. Market cycles continually play out more or less in the same way.

What we don’t know is the catalyst that sparks them, which is why timing is so hard to predict. My whole investment thesis is based around being a deep value investor. Understanding market cycles allows me to take calculated bets, that have assymetric upside, as the thesis plays out –– which generally means going against the crowd.

If we look at the market today, essentially all the big indexes have hit all-time highs despite a recent sell off. This opens the possibility that we may have just experienced our first profit take by the big boys.

It makes me question, 'where could that money be flowing?'

Through all the chaos we can then generally predict where capital is going to flow into next by knowing the following:

What is cheap and what is expensive.

Although not an exact replica of the dotcom bubble, we can look back at previous cycles and see a number of similarities. The NASDAQ is experiencing a high concentration towards tech and AI stocks. The Mag-7 is over 40% of the value of the NASDAQ –– which is unbelievably absurd.

When we compare today's concentration to the dotcom bubble of 2000, the bubble only experienced a 25% concentration toward the dotcom stocks in the NASDAQ.

Needless to say, pressure is amounting.

This is different to the ‘08 crash where we had a full liquidity crisis. There are still cheap assets out there which leads me to believe that we will experience more of a rotational top. This causes fund managers to sell overpriced stocks and rotate capital into 'value' assets instead of a heavy concentration in 'growth' assets.

What most retail investors don’t realize is that it takes time for Heggies to move that money, and often times they manipulate the market. They have the ability to move stock prices and will intentionally do so to lure retail in. They pump prices to levels they want to sell, then turn on the media jets to make retial believe that 'it's the next big thing' before unloading their positions.

This does two things: drives the price to their sell levels and gives them an offramp to unload the stocks onto retail investors.

As a result of them doing this multiple times, we see multiple drives to the high as they take profit in smaller chunks not to cause the market to crash.

Unfortunately, someone must be left holding the bag... Just don’t let that be you.

Bond's Are Telling us Something

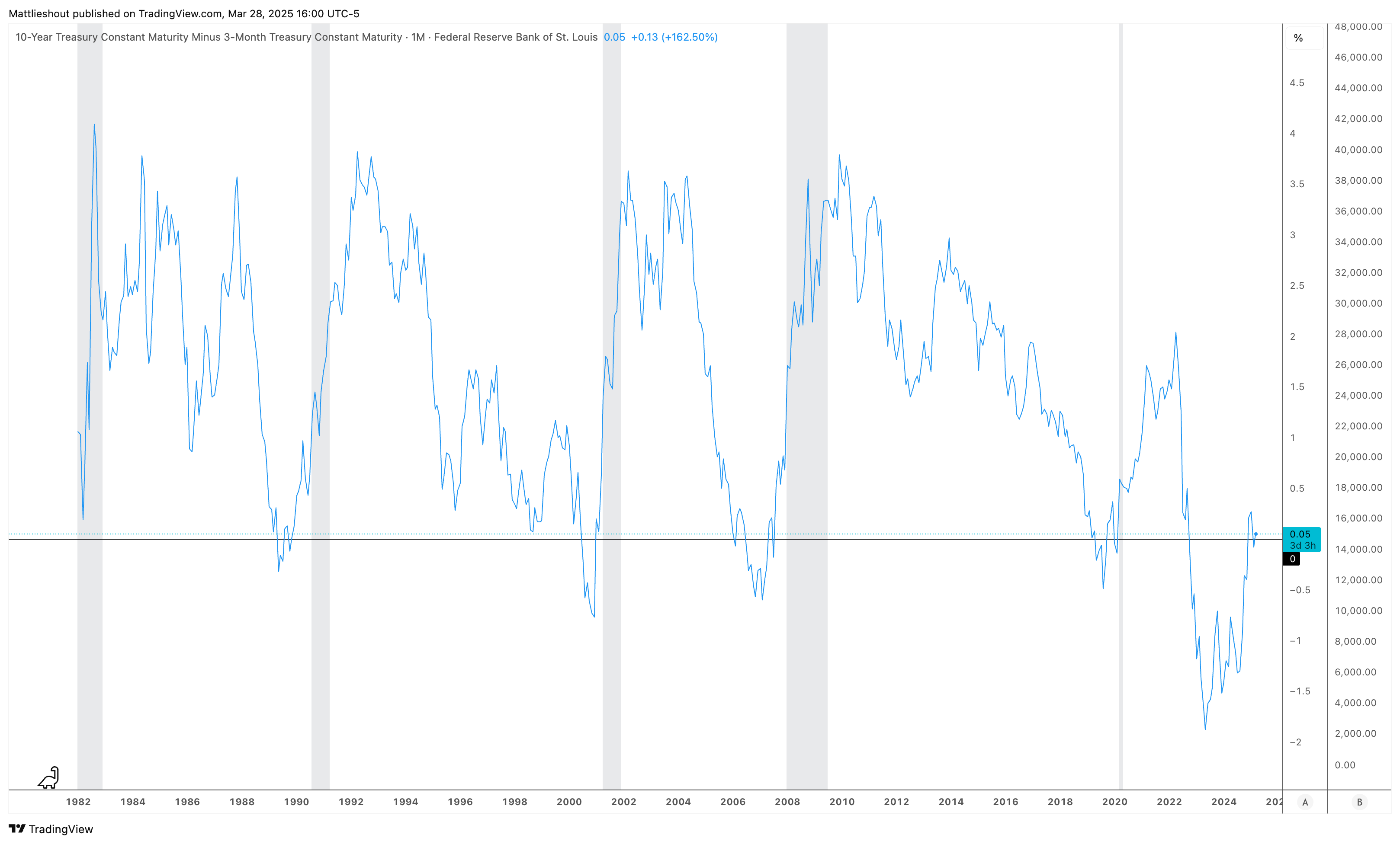

If you don't believe me about a tech cool off, look at the yield curve inversion. It has predicted every major recession in the past and now people questioning its validity and saying, ‘this time is different’.

This is no different to what happened after the '08 bubble. Financial media started questioning that P/E ratios had no place in modern finance.

The 3-month yield curve has been inverted for the past 3 years finally becoming un-inverted in the last 3 months. If we look back on previous cycles it shows that once it becomes un-inverted we should be concerned. It’s screaming signs that we should be taking less risk than most people currently are.

The gray boxes below indicate recessions.

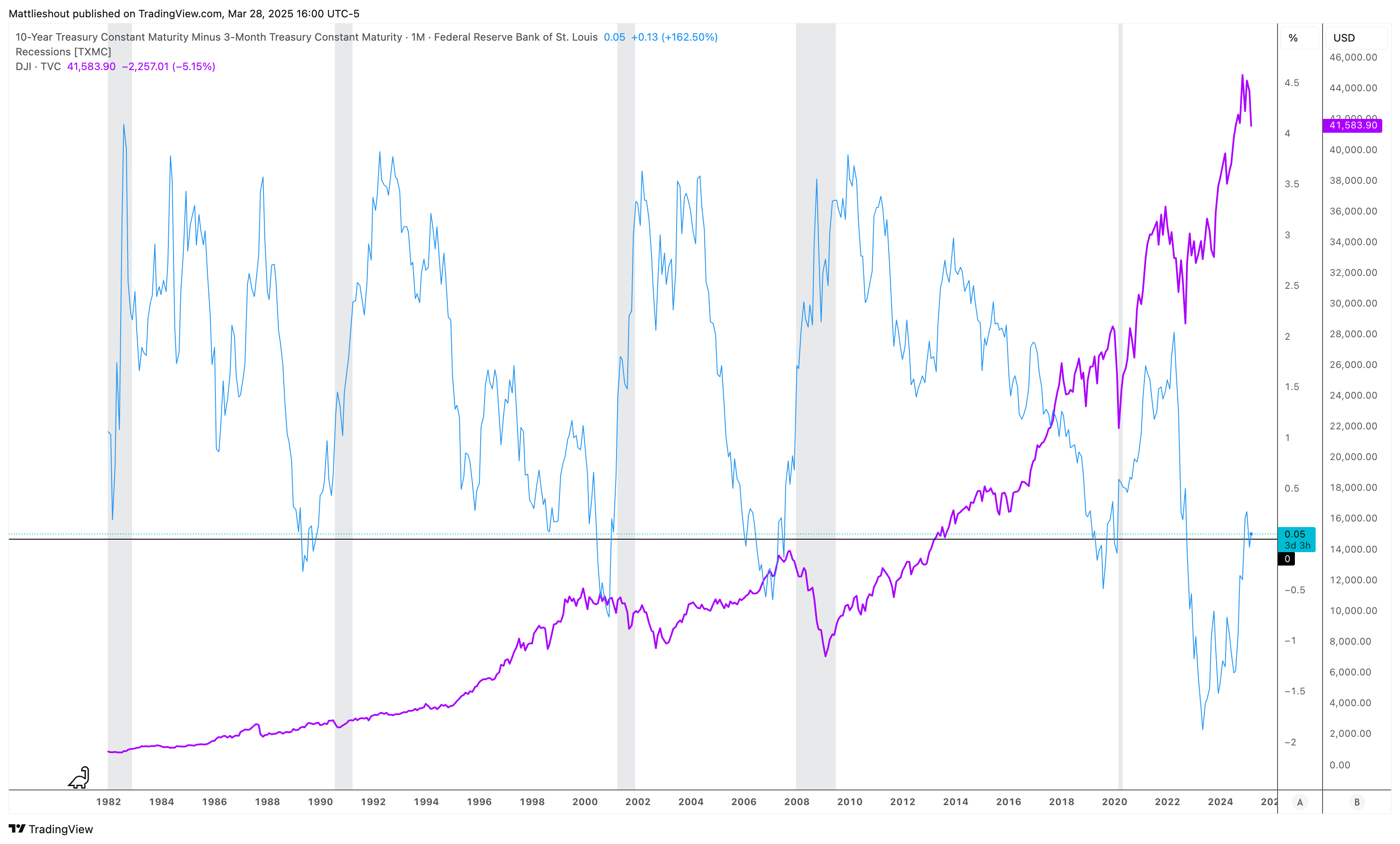

Now let’s throw the DJI (Dow Jones) on there in purple to show the price decline of major indexes during recessions.

And don’t think for a second that dropping rates will fix this.

Let's put the FEDFUNDS rate on the chart in red.

Would you look at that.. The Fed always drops rates as we enter into recessions.The only issue is that the FED is once again caught offside and only drop rates when s**t hits the fan –– or when their banker buddies convince them too. By that time it's too late.

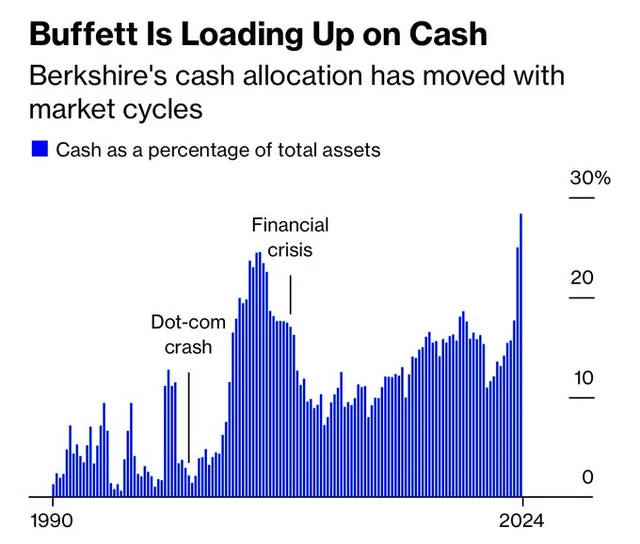

You’ve got to wonder why Buffet is sitting on a chunk of cash.

Buffet has a unique challenge that most retail investors don’t think about. As a result of managing so much money, he can’t buy the majority of public companies due to their marketcap. Yes, he can take small slithers but buying a billion dollars of stock will absolutely blow out the free float on most of the stocks. Must be tough when you manage so much money..

That’s why he started buying companies out right ie. Dairy Queen, Flying J, Maverik and so on.

Ok, back to the Market Top.

If we believe we are in the later stages of a business cycle (similar to 2000), then capital needs to rotate somewhere and that somewhere could be cash or cash equivilents (T-Bills).

Below I compare the topping structure of the RTY in 2000 vs. today. Although not a complete replica, it gives us guidance on what to expect. As these Heggies start profit taking and rotate the capital, we should see the capital flow into smaller, cheaper companies resulting in the RTY appreciating. This will create a blow-off top that is accompanied with euphoria.

Our job is to find out where that capital could be flocking to. Normally, this capital starts flowing to where there is great disparity in the market. Areas where no one is looking and no one is talking about.

I have pointed out in previous reports that commodities are the cheapest they have been in the last 40 years.

Once we discover what is cheap, we need to find a tool that expresses that view. That’s where the stock picking or ETF picking comes in.

Remember that 80% of the price appreciation in companies come from a sector wide appreciation, not one stock taking off.

So, it might be a good idea to put 80% of your time finding the sectors you want to be invested in, and 20% looking at your choice of vehicle.

Crypto Market Update

The Consolidation Continues

The last 120 days has predominately been sideways or down in the crypto market. Strange.. It's similar to the RTY. For those thinking crypto is untouchable and detatched from the rest of the markets, I have news for you. It’s all just one big pool of cash sloshing around –– it's all connected.

If we get the bounce we talked about earlier in the RTY, we should also get a bounce in crypto. Although the fun may be short lived, this is how I am positioned.

The Crypto Total Market Cap is beginning to show signs on the underlying indicators that the buyers are stepping back in.

- We have reached the highest levels on the Stoch RSI since the breakdown began.

- The MACD has started curling back up (once again, indicating buyers are stepping in).

- RSI had bullish divergence (price went lower but strength went higher indicated by black lines).

All signs point to a bottom forming. This could form some sort of a range for a while as buyers and sellers fight back and forth at this price to determine the next direction. So don't think I'm expecting a moon shot immediately.

Emotional Management

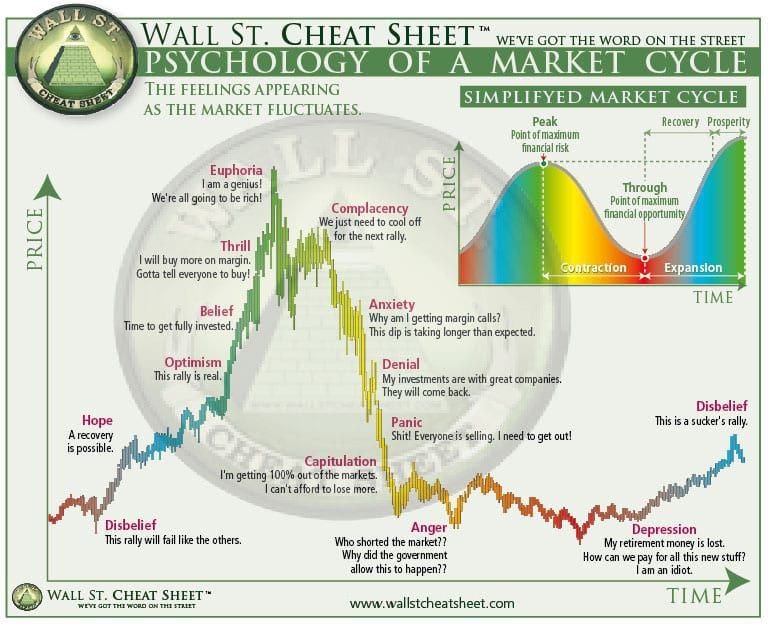

While we are in a moment of capitulation (both time and price-based capitulation) we should discuss how the sentiment can change –– because it inevitably will.

Crypto Twitter is essentially beat to death right now. It started with only Ethereum but has slowly transpired to all other crypto assets. Feels like a crypto depression out there.

Now think about what it will be like if we create new highs with ETF’s getting approved left and right. What will the sentiment be at that point?

Insert chart below:

We are emotional creatures that swing from depression to euphoria. The market shows the scars of our collective emotional decisions. We will reach a time of euphoria once again but what will you do when these emotions are running high?

Be mindful of your emotional state during both times and outline a plan before the euphoria so you can un-emotionally act on your portfolios.

I'll give you my emotional management secrets in the next newsletter..

Until then, stay skeptical,

Matt Lieshout

DISCLAIMER: This newsletter is not investment advice. It is provided solely for educational purposes. Our aim is to enhance your understanding and decision-making as an investor; however, you are solely responsible for conducting your own due diligence and consulting a qualified financial professional prior to making any investment decisions. Skeptical Investing and Matthew Lieshout reserve all rights to the content of this publication and related materials. Proceed with caution and at your own risk.

Sparked Intrigue?

Join our mailing list to receive the Skeptical Insight Newsletter where we cover everything from geopolitics to macro investing and everything in-between.

We hate SPAM. We will never sell your information, for any reason.